Pension Scheme A & B : Discover how to easily switch your pension payment method from Scheme B to Scheme A. Learn about the benefits, procedures, and complete guide for more efficient pension management for government retirees.

Baca artikel ini dalam Bahasa Melayu :

Pension Scheme A & B

The Pension Scheme A & B is a vital program that provides financial security to government employees upon retirement. This initiative ensures a sustainable livelihood for members by offering two distinct pension payment methods. Here, we elaborate on the essential details about the Pension Scheme A & B and guide you through changing your pension payment method from Scheme B to Scheme A.

What is the Pension Scheme A & B?

The Pension Scheme is a retirement plan funded by the government or employers to offer financial benefits to workers after retirement. Within this framework, Scheme A and Scheme B represent two different methods available for pension disbursement.

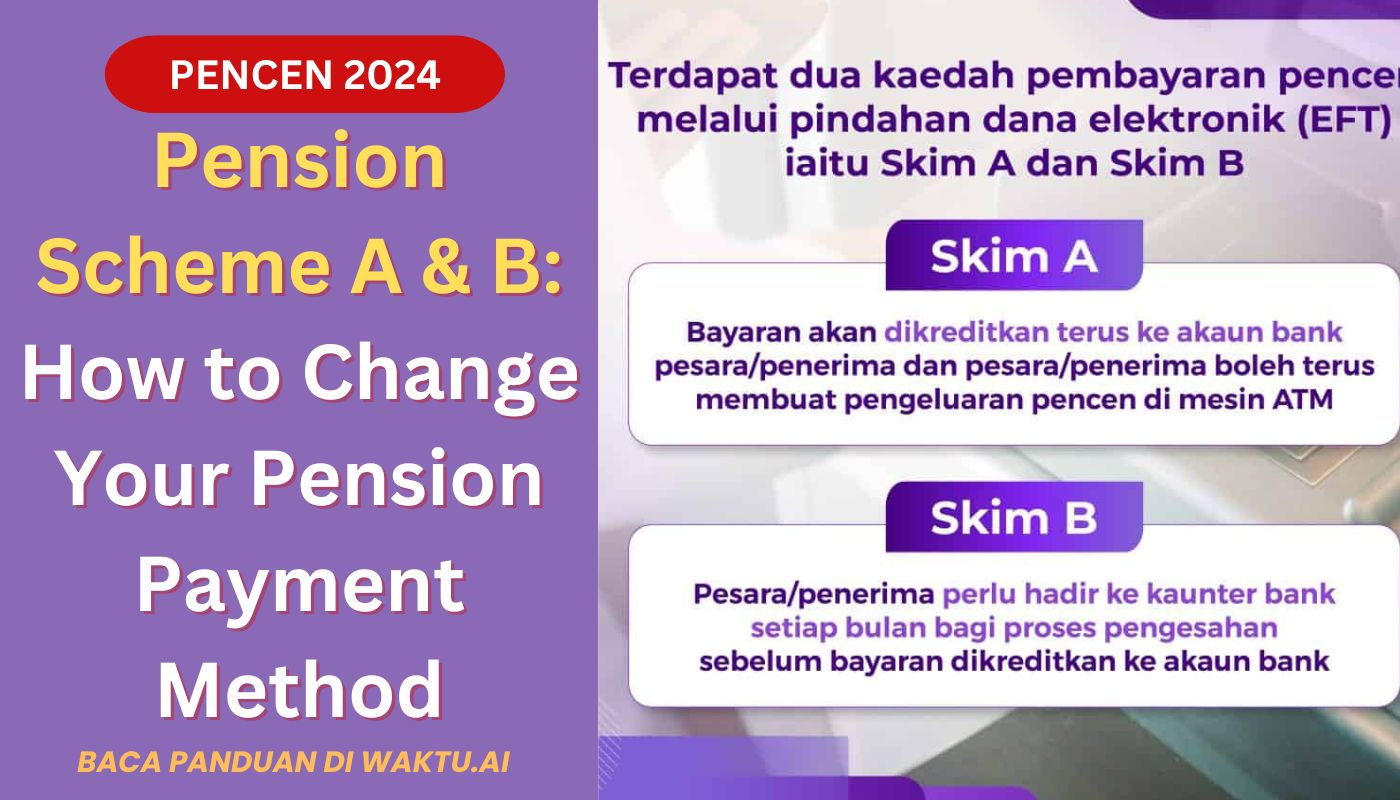

Payment Methods Under Pension Scheme A & B

- Scheme A:

- Monthly payments are directly credited to the retiree or beneficiary’s bank account, allowing immediate access through ATMs.

- Applicable to retirees with a spouse eligible for survivor benefits upon the retiree’s death.

- Scheme B:

- Payments are credited monthly to the retiree’s or beneficiary’s bank account.

- Requires the retiree or beneficiary to verify their identity at a bank counter each month before the pension is credited.

- Suitable for single retirees with no other beneficiary after their demise, minors, individuals with disabilities, and those unable to visit the bank due to physical constraints. A legal representative can be appointed for banking transactions using specific forms.

- Scheme A with Representation:

- Available for single retirees without other beneficiaries, allowing an appointed representative to manage banking transactions on their behalf.

Banks Participating in the Pension Payment System

The list includes renowned banking institutions such as Bank Muamalat, Maybank, CIMB Bank, and others, totaling thirteen banks that facilitate the pension payment process.

Apply Bantuan B40 : Senarai Bantuan JKM Untuk B40 & M40

Benefits of Payment through Scheme A

Choosing Scheme A for pension payments offers efficiency and convenience, eliminating the need to physically visit the bank each month and reducing the risk of suspended payments due to non-verification.

Changing Your Pension Payment Method from Scheme B to Scheme A

Transitioning from Scheme B to Scheme A is a straightforward process. It involves completing and submitting the Appointment of Representative form (JPABPSKPB08), along with a copy of the appointed representative’s ID card. The form is available for download and can be submitted through various channels to KWAP.

Frequently Asked Questions

- Eligibility for Medical Expense Claims: Federal retirees and their qualified dependents are eligible.

- Procedure upon the Death of an Officer: Family members must contact the last department to ensure the documentation for survivor benefits is processed timely.

- Replacing a Lost Pensioner Card: Can be done at KWAP’s customer service or JPA4U service counters.

- Minimum Pension Amount: The minimum pension is RM1000 for services not less than 25 years, effective from January 1, 2018.

- Implications of Unclaimed Pension Under Scheme B: Unclaimed pensions for three consecutive months will lapse, stopping further payments until reactivation by contacting KWAP.

Further Information

For additional details, contact KWAP through their office line, call center, fax, or email provided on their website.

By maintaining clarity and brevity, this revision aims to facilitate a better understanding and simplify the process of changing pension payment schemes for retirees.

For more information, you can contact:

Phone: +603 8887 8700 (Office), +603 8887 8777 (Call Center)

Fax: +603 8887 8770

Email: mypesar@kwap.gov.my

Address:

Level 11, Skytech Tower 2, MKN Embassy Techzone, Jalan Teknokrat 2, Cyber 4, 63000 Cyberjaya, Selangor.

By understanding and utilizing Pension Scheme A and B, retirees can enjoy their golden years more calmly and organized.

Read this : Tarikh Bayaran Pencen Bulan Julai 2024